Paytm warned of job cuts and mentioned it might trim non-core belongings after reporting its first gross sales decline on file, reflecting fallout from a regulatory probe that curtailed a lot of the Indian fintech pioneer’s enterprise.

As soon as a job mannequin for India’s nascent startup financial system, Paytm’s web losses swelled several-fold to Rs. 5.5 billion ($66.1 million) for the three months by March. The corporate referred to as One 97 Communications reported a 2.6 % slide in income to Rs. 22.7 billion — the primary drop since its 2021 stock-market debut. Its shares slid as a lot as 2 %.

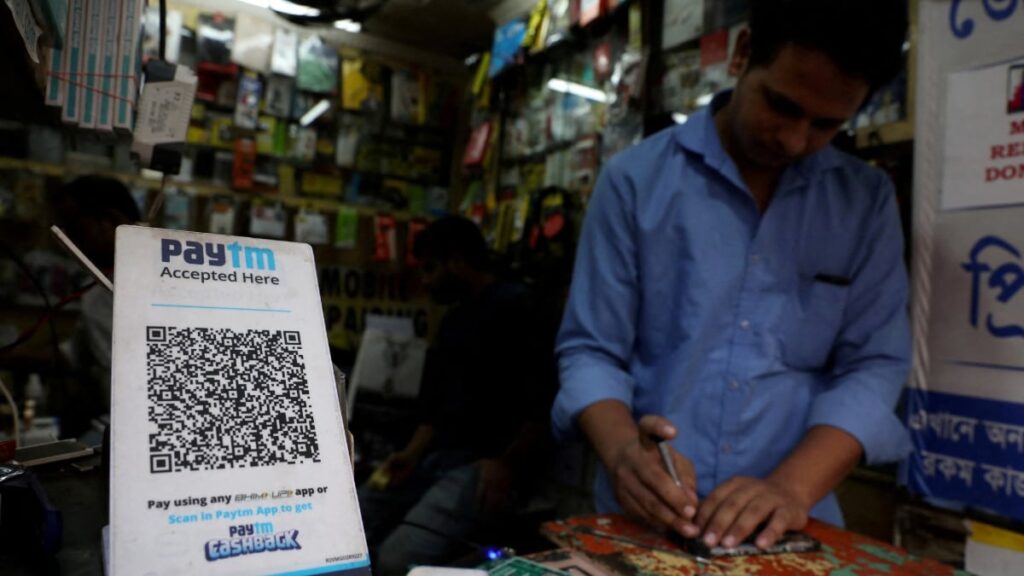

Paytm, based by then-celebrated Indian entrepreneur Vijay Shekhar Sharma in 2010, is struggling to get well after a finance watchdog in January ordered a key banking affiliate to wind down. The restrictions dealt a blow to Paytm’s fame and prompted hypothesis that prospects might defect to rivals akin to Walmart’s PhonePe.

On Wednesday, Paytm mentioned it was worthwhile earlier than curiosity, taxes, depreciation and amortization, and earlier than taking worker incentives under consideration. It warned that revenues ought to slide additional to fifteen billion to 16 billion rupees within the June quarter, however anticipated “significant enchancment” thereafter. To get there, the corporate meant to streamline the group, lower worker prices and “prune” non-core companies, it mentioned in an announcement.

Paytm, which additionally competes with monetary providers provided by Amazon.com, Alphabet’s Google and billionaire Mukesh Ambani’s Jio Monetary Companies, is making an attempt to place its regulatory points behind it.

Its shares have misplaced half of their worth because the authorities ordered Paytm Payments Bank, which processed transactions for Paytm, to halt its key operations, citing non-compliance. The banking affiliate referred to as PPBL is not managed by Paytm, although it’s a part of founder and Chief Government Officer Sharma’s fintech empire.

Sharma has since moved swiftly to regular the ship by forging new partnerships with a few of India’s prime lenders together with Axis Financial institution Ltd., HDFC Financial institution Ltd. and State Financial institution of India Ltd. The alliances will assist Paytm energy immediate cash transfers for purchasers by linking banks with its fintech app. Paytm beforehand used its financial institution affiliate to run its digital wallets and funds site visitors.

The agency can be utilizing associate banks for clearing service provider transactions.

On Wednesday, Paytm mentioned it misplaced about 4 million month-to-month transacting customers throughout the March quarter. It disbursed 57.76 billion rupees in loans, down sharply from Rs. 155.35 billion within the earlier three-month interval.

“We anticipate near-term monetary impression to our income and profitability, on account of disruptions confronted in our enterprise in This autumn,” Sharma mentioned in a letter to shareholders. “This consists of regular state impression on account of pausing of PPBL pockets. We had additionally paused just a few different funds and mortgage merchandise to our prospects over the last quarter, and I’m completely satisfied to share that many such merchandise have been restarted or within the strategy of beginning quickly.”

© 2024 Bloomberg LP