Nvidia CEO Jensen Huang is as bullish as ever about his firm’s future, repeating his sentiments that DeepSeek received’t influence gross sales, he mentioned throughout the newest earnings name on Wednesday.

Hypothesis that DeepSeek’s R1 model required far fewer chips to coach fueled a record drop in Nvidia’s stock price last month.

However throughout the earnings name, Huang touted R1 as an “wonderful innovation,” emphasizing that it and different “reasoning” models are nice information for Nvidia since they want a lot extra compute.

“Reasoning fashions can eat 100 instances extra compute, and future reasoning fashions will eat way more compute,” Huang mentioned. “DeepSeek R1 has ignited international enthusiasm. It’s a wonderful innovation, however much more importantly, it has open sourced a world-class reasoning AI mannequin. Almost each AI developer is making use of R1.”

Nvidia’s gross sales present no indicators of slowing down. Nvidia reported one other record-breaking quarter that noticed its income attain $39.3 billion — exceeding each its own projections and Wall Street estimates. And it mentioned it expects income for the subsequent quarter to be up once more, to round $43 billion.

Nvidia’s knowledge middle gross sales practically doubled in 2024 to $115 billion and rose 16% from the earlier quarter, per the tech big’s earnings release.

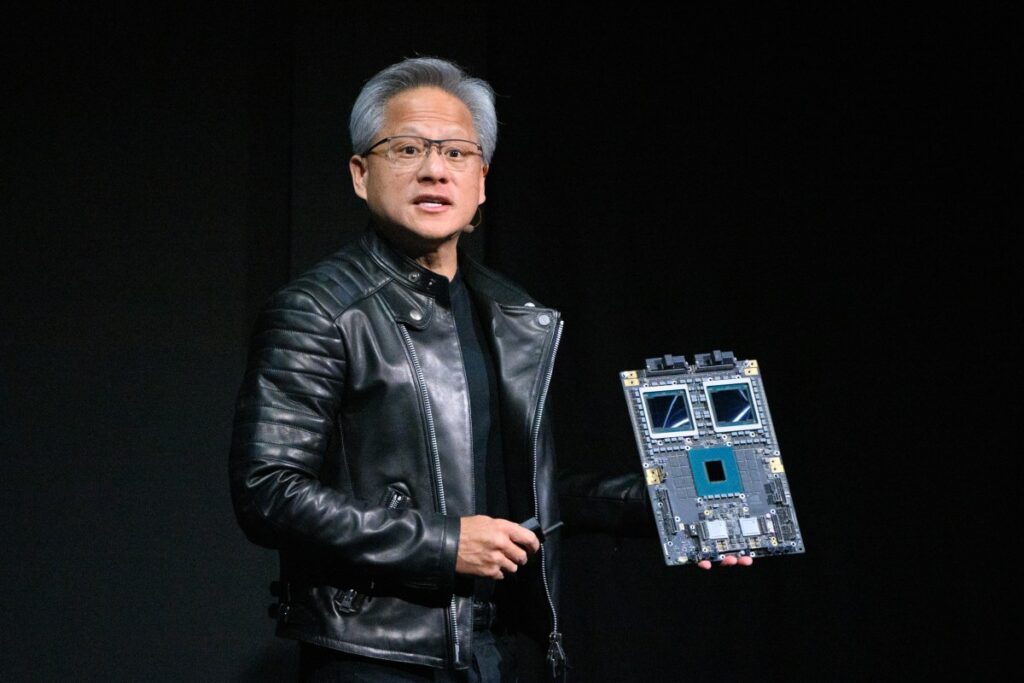

Through the name, Huang touted Nvidia’s newest Blackwell chip as being custom-built for reasoning and mentioned that present demand for it’s “extraordinary.”

“We are going to develop strongly in 2025,” Huang mentioned.

Certainly, regardless of final month’s panic over DeepSeek, the marketplace for AI chips exhibits no indicators of cooling off.

Since then, Meta, Google, and Amazon have all unveiled large AI infrastructure investments, collectively committing a whole lot of billions for the approaching years.