For many years, {couples} going by means of in vitro fertilization have needed to spend tens of 1000’s of {dollars} on the procedures with no assure of success.

It’s not solely an emotionally draining course of, however a financially exhausting one as nicely.

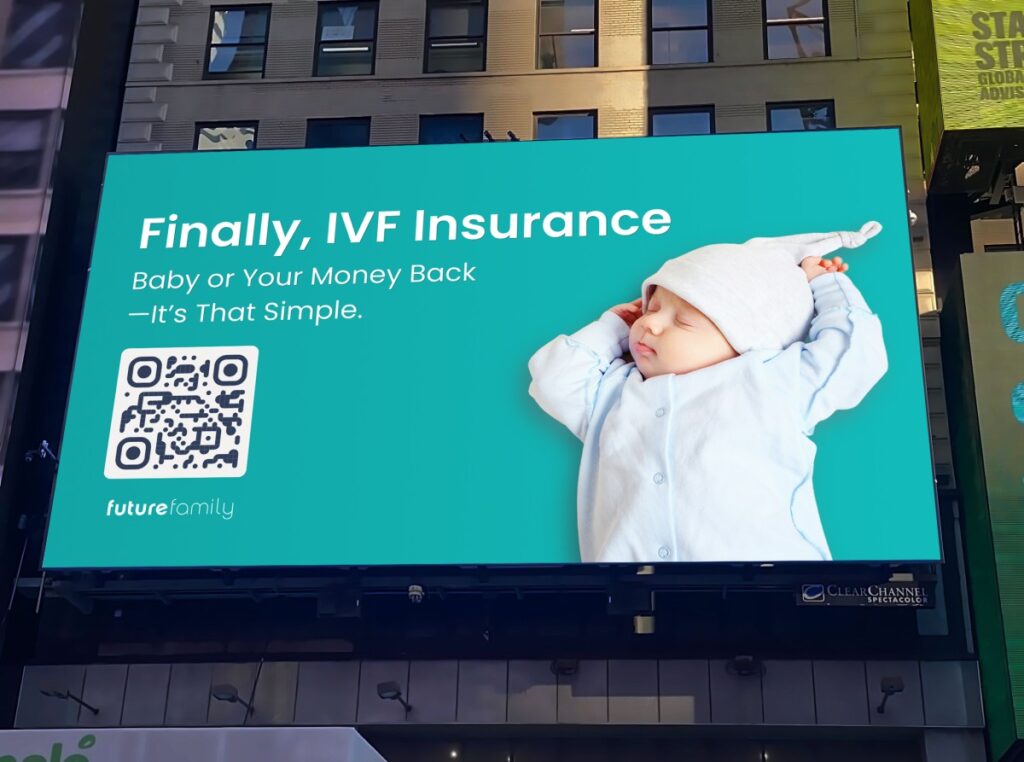

San Francisco-based startup Future Family needs to assist ease a few of that burden for {couples} with a brand new IVF insurance coverage product in america. Constructed with the assist of Munich Re Ventures — the enterprise arm of worldwide reinsurer Munich Re — the brand new providing basically presents a money-back assure to these going by means of IVF.

CEO and co-founder Claire Tomkins likens it to journey insurance coverage. A pair pays 20% insurance coverage upfront earlier than beginning an IVF cycle. In the event that they don’t have a child after two cycles or lose the newborn inside two weeks of start, they will file a declare to be reimbursed.

The price of two IVF cycles can attain $40,000, relying on location. With Orange Defend, Future Household’s new product, the common price of safety is $3,000 down and $999/month for 5 months. If remedy doesn’t succeed after two rounds, households can get a refund underneath their IVF insurance coverage coverage.

Orange Defend is out there at participating clinics nationwide. Households pays both through month-to-month installments or with lump sum funds. General, the coverage covers all IVF-related bills as much as the chosen protection restrict, with a most of $50,000. All eligible remedy prices might be included.

“Our objective is easy: to assist construct extra households by making IVF profitable, straightforward to afford, and fewer anxious,” stated Tomkins, herself a mom to 3 kids born by means of IVF. “IVF insurance coverage works like different varieties of insurance coverage — much like auto insurance coverage, the place you buy protection hoping you received’t have to file a declare.”

Eligibility standards is predicated on a spread of underwriting components, together with age and medical historical past, she stated. And sufferers aged 38 years or older who plan to make use of their very own eggs will not be at present eligible for protection. Nevertheless, sufferers 38 and older can qualify for protection if utilizing donor eggs. Different eligibility components embrace life-style habits reminiscent of tobacco use, supposed egg/sperm sources, and infertility historical past.

Since its 2016 inception, Future Household says it has labored with over 10,000 households to assist them navigate the IVF course of with quite a lot of choices, together with fertility financing for IVF and egg freezing, and one-on-one teaching. It says it additionally has distributed $200 million in credit score.

In whole over time, Future Household — a Startup Battlefield company — has secured $150 million in funding, together with $100 million in a credit facility introduced in 2018. Traders embrace Munich Re Ventures, TriVentures, MS&AD Ventures, ORIX, Side Ventures, Mindset Ventures, at.inc/, and OurCrowd. Its final elevate was a $25 million Series B introduced in April of 2022.

In vitro fertilization is an space long tackled by startups. Extra lately, a brand new fertility wellness firm, Lushi, emerged with $5 million in funding.