The conflict in Ukraine served as a wakeup name for Europe, and protection tech went from a sector that almost all European VCs didn’t contact to one of many high funding areas inside deep tech.

This shift is captured in Dealroom’s newest report on Defence, Resilience, and Security (DSR) in Europe, launched along with the NATO Innovation Fund (NIF), a multi-country €1 billion initiative making direct investments and backing funds on this area.

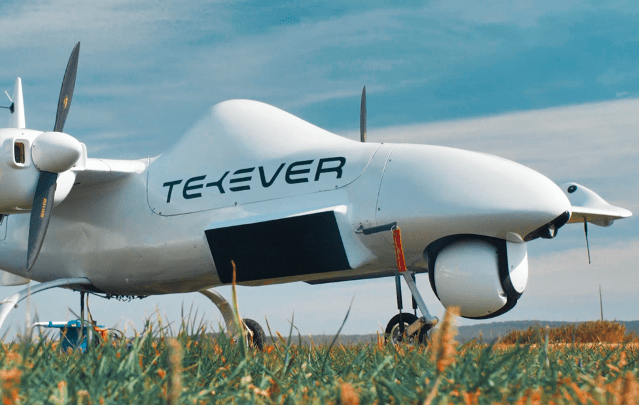

NIF’s portfolio consists of startups equivalent to Portugal-based dual-use drone firm Tekever, which raised a $74 million Series B in November. In combination, DSR startups secured a document $5.2 billion in enterprise capital final yr, up 24% in comparison with 2023 and practically 5x greater than in 2019.

Regardless of the surge, $5.2 billion is just twice as a lot capital as U.S. protection tech firm Anduril is reportedly seeking to raise only for itself. Nonetheless, that’s additionally an all-time excessive of 10% of all VC funding in Europe — a two-and-half-fold improve over the previous two years, based on Dealroom.

“Urge for food for protection, safety, and resilience startup funding is unrecognizable in Europe from just some years in the past,” its founder and CEO, Yoram Wijngaarde, stated in a statement. “It follows an ongoing pattern of placing capital and innovation to work on Europe’s core strategic wants, through deep applied sciences.”

With DSR now accounting for one-third of all deep tech enterprise funding in Europe, it’s manifest that the 2 overlap. That’s as a result of DSR is broader than protection tech, with the acknowledgment that provide chain, quantum applied sciences, and vitality could be equally essential for the area’s sovereignty.

Which means that a broader vary of startups now fall into the DSR pipeline, particularly now that rising protection budgets make the thought of promoting dual-use expertise in Europe much less daunting. NIF itself additionally hopes to assist on that entrance; it lately appointed British Military veteran John Ridge as its chief adoption officer.

Fragmentation and sluggish adoption apart, VC urge for food has lengthy been an impediment, however that is altering. The rise of dual-use startups contributed to this evolution: It made it simpler for generalist VCs to accommodate the sector inside their mandate, which regularly prevents them from investing in pure protection tech, not to mention weapons.

Pure protection tech solely accounts for a smaller subset of general funding, however that’s additionally on the rise; a earlier Dealroom report anticipated a $1 billion tally for 2024, a fivefold improve since 2018. Conversely, a broader vary of European VCs at the moment are making investments adjoining to protection tech, with greater than 850 traders lively in no less than one DSR deal in Europe, based on the report.

This progress is especially placing in Germany; with Munich and Berlin as its most important hubs, it claimed Europe’s high spot in DSR funding in 2024, adopted by the U.Okay. and France. AI protection tech rising star Helsing, which relies in Germany, raised some $487 million in a Collection C led by Common Catalyst final yr.

Nonetheless, these diversifications take time. The Defence Fairness Facility (DEF), a €175 million fund ($182 million) launched in January 2024 by the European Fee and the European Funding Fund (EIF), is just about to announce its first investments, because the European Funding Financial institution (EIF’s father or mother group) needed to update its rules on dual-use expertise.

Of all challenges forward, nevertheless, a scarcity of founders isn’t one among them, as confirmed by latest protection hackathons throughout Europe. “Regardless of latest progress, protection, safety, and resilience tech stays a comparatively nascent sector, however the knowledge exhibits an lively pipeline of early-stage corporations seeking to change that,” Wijngaarde stated.