Normal Catalyst, the powerhouse enterprise agency, is contemplating an IPO, Axios reported Friday morning, citing “a number of sources.”

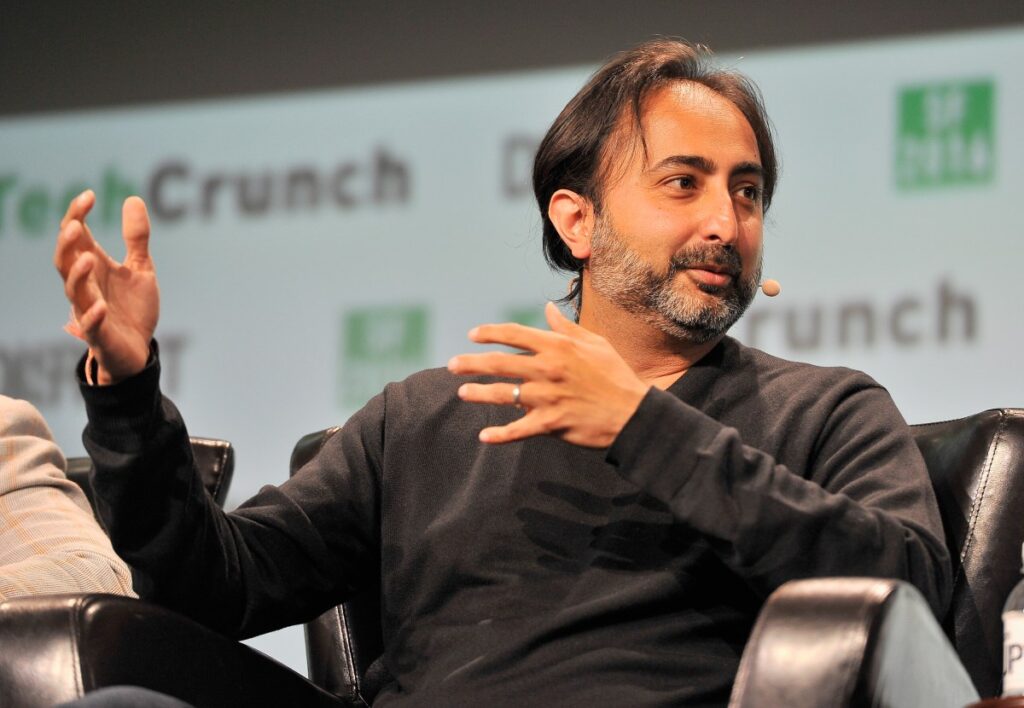

TechCrunch has reached out to the agency’s managing accomplice, Hemant Taneja, for remark. Within the meantime, these following Normal Catalyst’s trajectory gained’t be stunned by the prospect.

Based 25 years in the past as a small Cambridge, Mass.-based enterprise agency, Normal Catalyst (GC) began with $73 million in capital commitments. A decade later, armed with ballooning belongings and pre-IPO stakes in software program corporations like Demandware and Brightcove, Taneja and then-partner Neil Sequeira arrange store in a captivating yellow constructing with white trim on College Avenue in Palo Alto. There, GC shortly made its mark within the Bay Space, reducing software program offers harking back to its East Coast successes whereas additionally forging deep ties with Y Combinator that paid off. In 2011, the agency secured a stake in Airbnb. In 2012, it dedicated to backing each Y Combinator startup sight unseen.

That very same 12 months, in July 2012, GC led the Series B spherical for Stripe — now Y Combinator’s most profitable alum by valuation, even because the fintech big maintains it has “no immediate plans” to go public.

In the meantime, GC itself has grown exponentially. Although Sequeira left in 2015 to start out his personal store, GC in the present day has a sprawling crew with 20 managing administrators, over $30 billion in belongings, and workplaces from San Francisco to Bengaluru. It has additionally expanded far past conventional enterprise investing. As we noted in October after speaking with Taneja for a podcast, the agency is sort of unrecognizable from its former self. Amongst different strikes, it has launched financing merchandise, rolled out a wealth administration enterprise, is within the strategy of buying a small healthcare system in Ohio, and bought two smaller enterprise companies.

A query Axios asks — and it’s an excellent one — is whether or not GC would be the very first enterprise agency to go public. It’s not solely a query of whether or not the agency decides to maneuver ahead, however whether or not the mere speak of an providing hurries up the plans of different heavyweight companies like Andreessen Horowitz, which appear to have their eyes on the same prize.