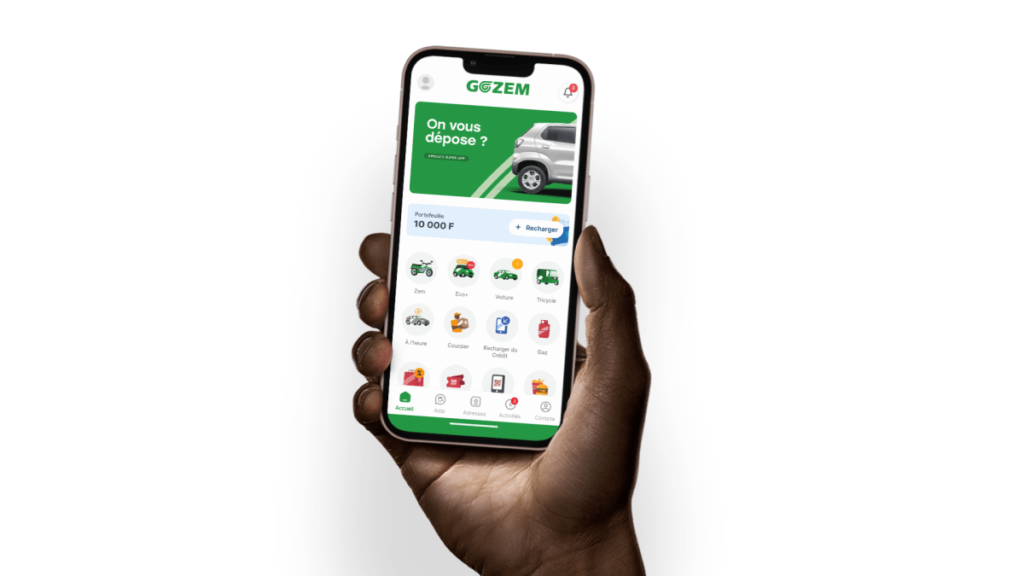

Since its launch in 2018 as a ride-hailing service in Togo, Gozem has steadily expanded throughout French-speaking West Africa, integrating a variety of providers because it sought to turn out to be a super-app. The corporate now provides ride-hailing, commerce, automobile financing, and digital banking throughout Togo, Benin, Gabon, and Cameroon.

Now, in a bid to scale its ecosystem, Gozem has raised $30 million in a Collection B funding spherical — $15 million in fairness and $15 million in debt — led by SAS Delivery Companies Providers and Al Mada Ventures. The corporate will use the funds to bolster its automobile financing service, and foray into new markets.

In accordance with the startup’s founders Gregory Costamagna and Raphael Dana, Gozem units itself other than different ride-hailing and automobile financing platforms by ensuring its drivers are financially safe and may entry profession development alternatives.

Gozem’s ride-hailing service covers bikes, three-wheelers and vehicles, whereas its automobile financing product is aimed toward serving to its drivers buy autos. It additionally lets staff on its platform make meals and grocery deliveries as a part of its e-commerce enterprise.

“Our principal consumer is the skilled driver,” Costamagna instructed TechCrunch. “We construct an ecosystem to assist drivers earn extra money and evolve of their lives. In the event that they’re profitable, our whole enterprise is profitable.”

When we covered Gozem’s $5 million Series A in 2021, it had simply piloted its automobile financing mannequin, partnering with native banks and deploying over 1,500 autos that yr. Since then, the corporate has collaborated with worldwide lenders and the Worldwide Finance Company (IFC) and now funds round 7,000 autos.

To draw drivers to its platform, the corporate purchases autos utilizing a mixture of debt and fairness, and drivers pays for these autos in installments. As a substitute of requiring upfront deposits, Gozem recoups prices by small deductions from drivers’ each day earnings. Uber-backed Moove, Asaak and MAX additionally provide automobile financing merchandise to drivers in numerous markets.

Gozem stated its program ensures that funds stay inexpensive relative to the driving force’s common earnings.

“We clarify to all our drivers that this can be a long-term journey,” Costamagna stated. “We finance their motorbike, [but then they can upgrade to a [three-wheeler], then a automotive, ultimately changing into full automobile house owners.”

The founders stated a good portion of the debt raised is slated for Gozem’s automobile financing vertical. The corporate can be working to boost one other $20 million within the coming months to help its growth throughout Francophone Africa over the following two years.

The super-app play

Many fintech and mobility platforms have tried to combine numerous providers below one tremendous app, however the mannequin hasn’t all the time been profitable. In Sub-Saharan Africa, for instance, fee apps which have tried to evolve into tremendous apps, like SoftBank-backed Opay, have seen little success.

Gozem, nonetheless, is seeing traction because of an method that’s much like Southeast Asian supply and ride-hail giants Seize and Gojek. A few of its rivals, like BOND-backed Yassir and MNT-Halan, have additionally explored related fashions in Africa throughout the Maghreb area and Egypt to some success.

At present, the corporate has practically 10,000 registered drivers, and greater than 1,000,000 customers have used its platform to this point. It says its month-to-month customers quantity within the tons of of hundreds.

Along with its core providers, Gozem has seen some development in digital ticketing, which is a part of its commerce division. The corporate resells occasion tickets throughout its markets, and says it has processed greater than 50,000 tickets in Togo alone for main concert events and occasions.

The corporate additionally forayed into digital banking (Gozem Cash) through the acquisition of Moneex in 2023. The service, at the moment stay in Togo, lets customers make cell funds, and based on the corporate, processes tens of millions of {dollars} each day.

Earlier than this newest Collection B, Gozem recorded run-rate gross merchandise worth of $50 million throughout its three product verticals. Dana stated the corporate expects to triple or quadruple its development in 2025 with the brand new capital.

He famous that the Collection B funding spherical validates Gozem’s mannequin, given the combo of commercial and monetary providers buyers becoming a member of its cap desk. SAS Delivery Companies Providers is a part of MSC Group, certainly one of Africa’s largest container terminal operators, whereas Al Mada Ventures is the enterprise arm of pan-African monetary providers conglomerate Al Mada.

“It’s validation as a result of we’ve buyers working on the bottom in the identical markets the place we function,” stated Dana.