One 97 Communications Restricted (OCL), which owns the model Paytm, has acquired the nod from NPCI to start out the person migration to new Cost System Supplier (PSP) financial institution handles, the corporate knowledgeable the inventory exchanges in a submitting on Wednesday.

Following NPCI’s approval on March 14, 2024 to onboard OCL as a Third-Celebration Software Supplier (TPAP) on the Multi Cost Service Supplier API Mannequin, Paytm has expedited the mixing with Axis Financial institution, HDFC Financial institution, State Financial institution of India (SBI), and YES Financial institution, the corporate mentioned in a press launch.

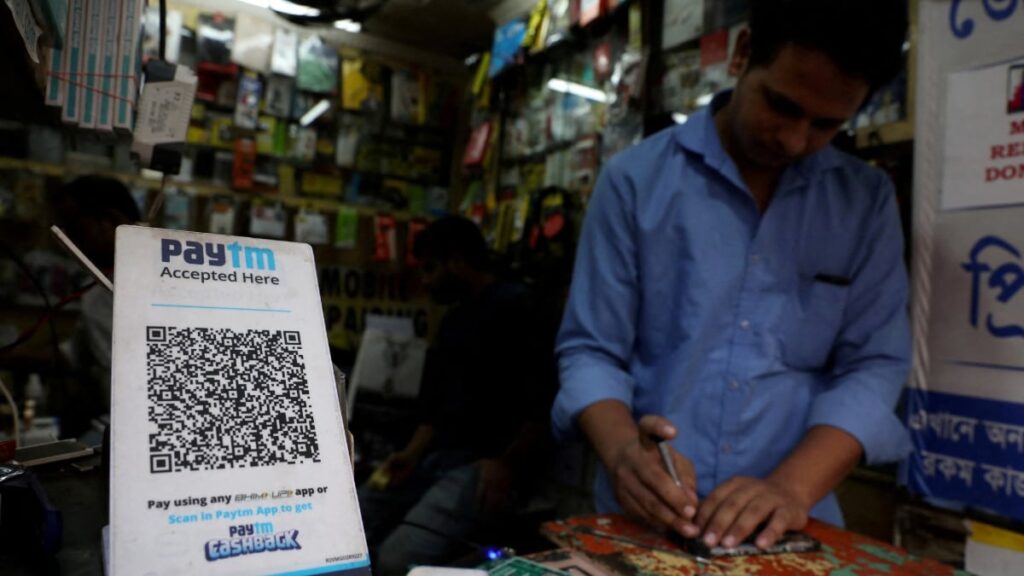

“One 97 Communications Restricted (OCL) that owns the model Paytm, India’s main funds and monetary companies firm and the pioneer of QR, soundbox and cell funds, has acquired go forward, yesterday from the Nationwide Cost Company of India (NPCI) to start out the person migration to new Cost System Supplier (PSP) financial institution handles instantly,” the discharge mentioned.

All 4 banks are actually operational on the TPAP, streamlining the method for Paytm to shift person accounts to those PSP banks.

The corporate has began transitioning ‘@paytm’ handles customers to those banks, guaranteeing seamless UPI funds, the discharge mentioned.

“We’re dedicated to develop the UPI ecosystem in partnership with NPCI to each nook and nook of India,” a Paytm spokesperson mentioned.

Leveraging the sturdy infrastructure of its banking companions, Paytm ensures uninterrupted and safe UPI funds for each customers and retailers by way of the Paytm app, the discharge mentioned.

In its submitting with inventory exchanges, the corporate mentioned that its communication is in continuation to earlier letter dated March 14, 2024, vide which “we had knowledgeable receipt of approval from the Nationwide Cost Company of India (NPCI) to the Firm to take part in UPI as a Third-Celebration Software Supplier (TPAP) beneath multibank mode”.

Earlier on March 14, NPCI had given approval to One97 Communications Restricted taking part in UPI as TPAP beneath the multi-bank mannequin.

This association was executed to allow present customers and retailers to proceed to do UPI transactions and AutoPay mandates seamlessly and uninterruptedly.

Nationwide Funds Company of India (NPCI) was included in 2008 as an umbrella organisation for working retail funds and settlement programs in India.