Many People reside paycheck to paycheck. Monetary freedom typically feels out of attain for many individuals. The important thing to vary lies in aware spending habits. This information unlocks pathways to tangible monetary transformation.

You’ll uncover actionable methods that lower your expenses. These decisions result in larger monetary well-being. Able to study 10 issues sensible spenders keep away from shopping for?

10. Rethinking Tipping Tradition

Have you ever seen the rise in tipping requests all over the place? Many really feel pressured to tip 20% at fast-food chains – even from eating places that use air fryer hacks to reheated frozen meals. That little display screen at drive-through home windows asks, “How a lot will you tip?” Making aware decisions is vital.

Digital cost methods have streamlined tipping however created widespread “tip fatigue.” You don’t have to tip for minimal service. Skip ideas at locations the place you serve your self. Keep away from pointless prices and tip solely when the service actually deserves it.

Hitting “No Tip” on a display screen typically feels as awkward as declining a buddy’s horrible do-it-yourself kombucha. However bear in mind – you’re answerable for your cash, not social strain.

9. Avoiding Meals Supply Providers

Meals supply apps stack charges larger than a Jenga tower in an earthquake. The common order contains service charges, supply costs, and inflated menu costs that considerably improve your complete price.

Decide up your takeout as an alternative. This protects money and offers you a quick escape from residence. Skipping supply frequently can add as much as substantial yearly financial savings, in accordance with Nationwide Debt Reduction.

Your meals arrives hotter, brisker, and cheaper. Plus, the restaurant retains extra revenue with out third-party charges (and also you get to really feel smugly superior to your delivery-dependent neighbors).

8. Decluttering As an alternative of Utilizing Self-Storage

Many organizing consultants promote decluttering for monetary financial savings. People spend billions yearly on self-storage. The common unit prices will be substantial every month.

Some individuals spend 1000’s over years to retailer gadgets value much less than the storage prices. When lastly sorted, many uncover these possessions might match into just some small bins.

Self-storage models are like costly resorts the place your forgotten belongings go on trip – besides they by no means ship postcards and also you foot the invoice. Promote usable gadgets on-line or donate them to charities as an alternative.

7. Skipping Souvenirs and Knick-Knacks

Souvenirs rapidly lose their attraction when you convey them residence. They typically lack sensible use and collect mud on cabinets. Vacationer trinkets not often ship the emotional worth they promise.

Pictures and movies create extra significant recollections with out bodily baggage. Digital recollections don’t require dusting, space for storing, or eventual disposal.

That “genuine” miniature Eiffel Tower was mass-produced in a manufacturing unit 1000’s of miles from Paris. Your digital images really seize the true deal – and so they don’t set off steel detectors at airport safety.

6. Fundamental Clothes and Avoiding Frequent Purchases

Quick vogue empties your pockets quicker than youngsters empty the fridge. Give attention to constructing a wardrobe with high quality fundamentals that final years, not months.

One sensible shopper reviews sporting the identical dependable gown shirt for over eight years. One other has owned only one well-made go well with for a decade, saving 1000’s in comparison with frequent replacements.

Purchase new garments solely when actually wanted. Create a “one in, one out” rule to keep up your closet dimension. High quality items may cost extra upfront however present higher worth over time.

5. Saying No to Prolonged Warranties

Prolonged warranties typically serve retailers extra than prospects. The guarantee market is substantial and rising quickly, in accordance with market analysis.

Save that cash as an alternative. Construct an emergency fund to deal with sudden repairs your self. This method provides you management fairly than combating with guarantee firms over declare particulars.

Guarantee claims processes are designed like on line casino video games – the home normally wins. Your emergency fund has no wonderful print, no exclusions, and works for any breakdown and not using a customer support name.

4. Avoiding Curiosity on Client Debt

Bank card rates of interest are usually excessive. This makes debt an costly luxurious you’ll be able to’t afford. Avoiding client debt saves vital cash in curiosity funds.

Pay for purchases with cash you’ve got. Wait till you’ll be able to afford gadgets outright fairly than financing them. The endurance required builds monetary resilience. Should you’re tech-savvy, think about testing the best Android tablets, which provide affordability with out compromising high quality.

Households who keep away from bank card debt can save tons of or 1000’s in curiosity funds. Debt-free residing supplies a freedom that no impulse buy can match.

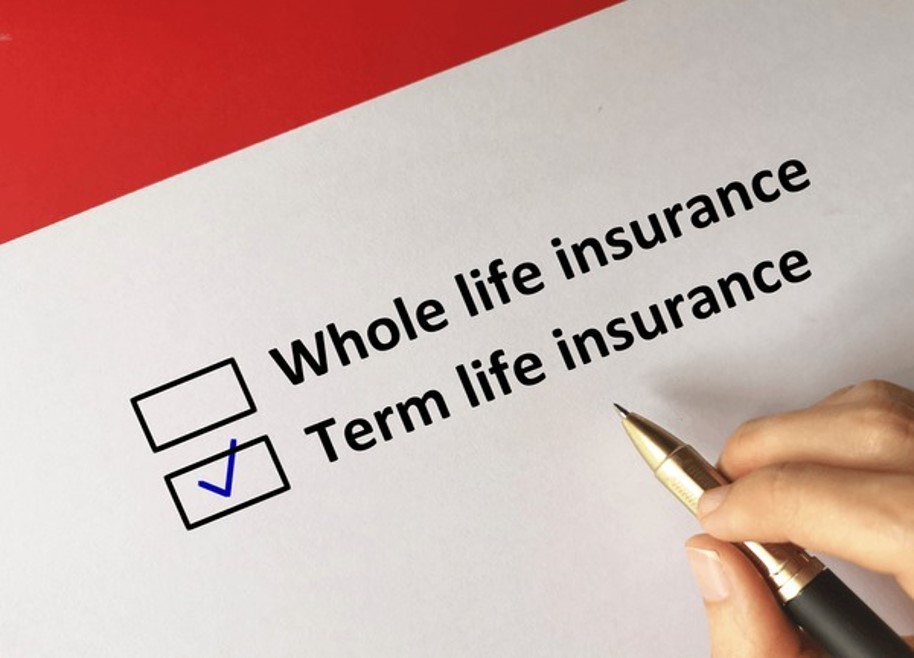

3. Selecting Time period Life Insurance coverage Over Entire Life Insurance coverage

Entire life insurance coverage insurance policies include excessive charges and show troublesome to cancel. Time period life insurance coverage presents superior worth for most individuals. A 30-year time period coverage supplies protection when you construct monetary safety.

The distinction? Time period life insurance coverage usually prices considerably much less than entire life insurance coverage with equivalent loss of life advantages. This represents substantial potential financial savings over a long time.

Insurance coverage brokers pushing entire life insurance policies are like used automobile salesmen making an attempt to promote you undercoating – it sounds vital however not often delivers worth proportional to its price.

2. Skipping Extravagant Presents

Extravagant presents typically add pointless monetary pressure with out proportional pleasure. Folks recognize thoughtfulness greater than value tags. Significant experiences create stronger connections than bodily presents.

Think about actions, handmade gadgets, or sensible presents that align with wants. Small gestures like occasional flowers or shared experiences foster lasting relationships with out extravagance.

One household changed vacation present exchanges with a shared cooking expertise. They saved tons of whereas creating recollections that didn’t want batteries or meeting directions.

1. Avoiding Impulsive Purchases

Impulse buying undermines monetary objectives one swipe at a time. Analysis reveals many impulse urges disappear after ready only a day or two.

Implement a easy cooling-off interval earlier than unplanned purchases. Ask whether or not the merchandise solves a real drawback or just creates a momentary thrill.

On-line purchasing carts needs to be handled like in a single day refrigeration for leftovers – if it nonetheless appears interesting tomorrow, possibly it’s value having. Your future self will recognize the rising financial savings account greater than one other forgotten buy.